irs tax levy form

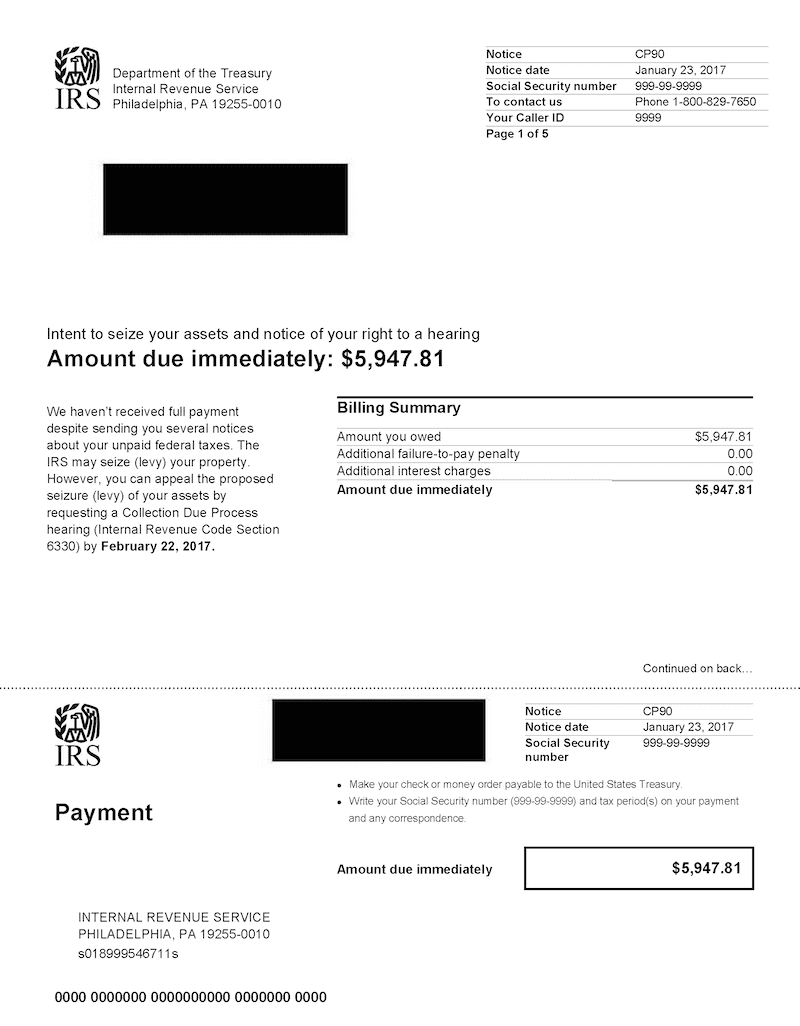

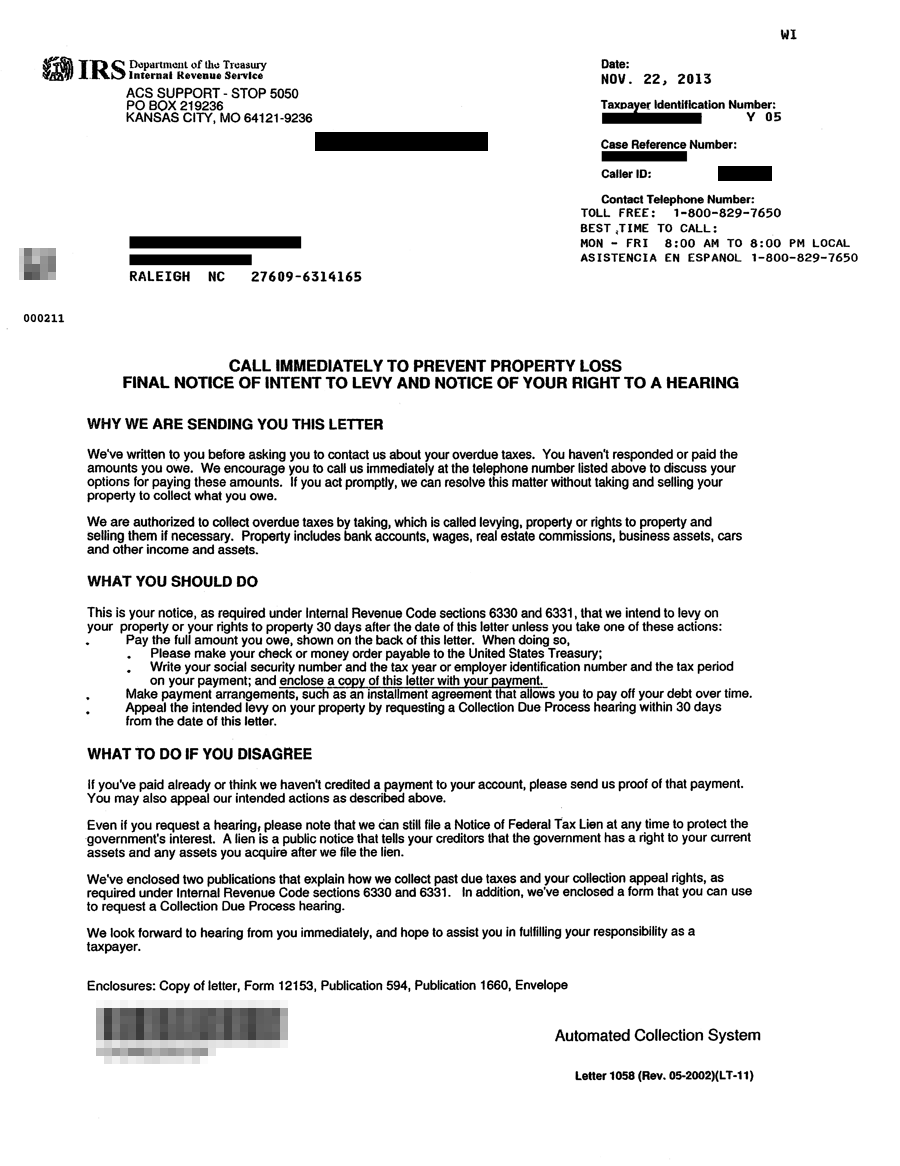

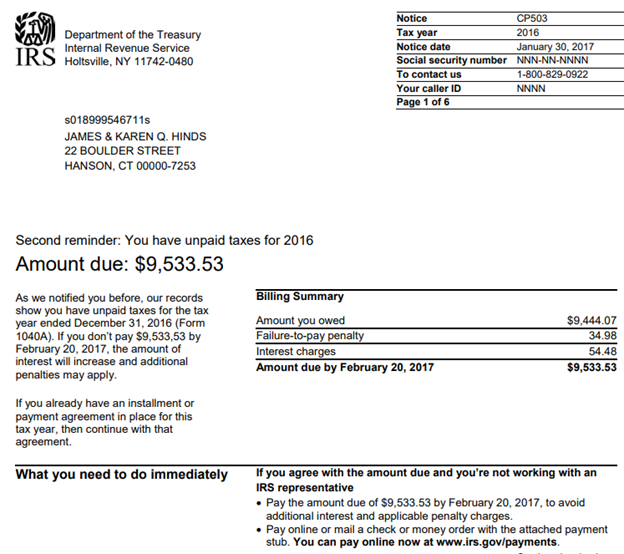

But its not permanent. A levy is a legal seizure of your property to satisfy a tax debt.

Irs Tax Levy Ace Back Tax Services

Complete Edit or Print Tax Forms Instantly.

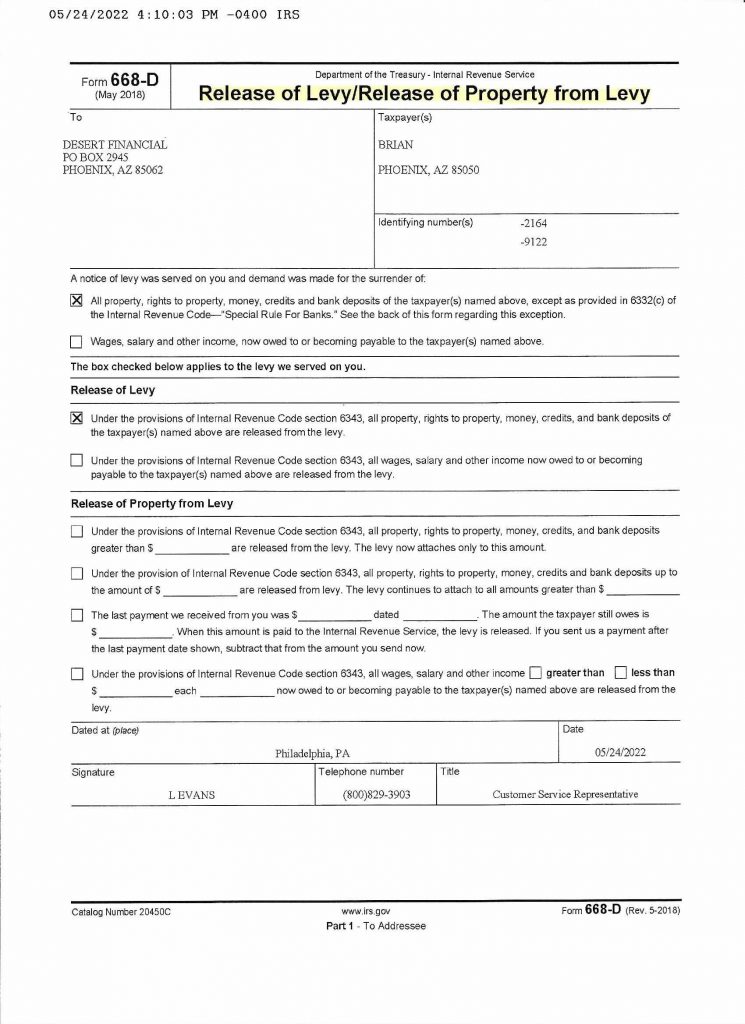

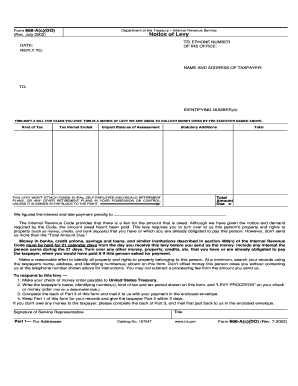

. Ad Stop Remove an IRS Levy Fast. Levy Relief Form 668-A Notice of Levy bank Form 668-B Levy seize a taxpayers property Form 668-D Release of Levy Release of Property from Levy third party holders of. Collection Appeal Request February 2020 Department of the Treasury - Internal Revenue Service Instructions are on the reverse side of.

IRS Tax Levy Explored. Ad 4 Simple Steps to Settle Your Debt. Trusted Reliable Experts.

Read the Form carefully. No Fee Unless We Can Help. Ad 668-WcDO More Fillable Forms Register and Subscribe Now.

You May Qualify For An IRS Hardship Program If You Live In New York. NY RP-6704-A1 More Fillable Forms Register and Subscribe Now. Levy Relief Form 668-A Notice of Levy bank Form 668-B Levy seize a taxpayers property Form 668-D Release of Levy Release of Property from Levy third party holders of.

To ensure the correct exemption amount is excluded from levy your employer will ask you to complete a Statement of Exemptions and Filing status Form 668-W Part 3. No Fee Unless We Can Help. Review Comes With No Obligation.

CPA Master Tax X-IRS Agent 28 Yrs Exp Can Help. Get Your Free Tax Review. Levies are different from liens.

Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Levy Relief Form 668-A Notice of Levy bank Form 668-B Levy seize a taxpayers property Form 668-D Release of Levy Release of Property from Levy third party holders of. If you have a tax debt the IRS can issue a levy which is a legal seizure of your property or assets.

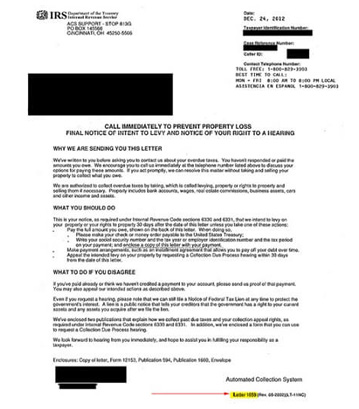

Ad Speak With A Proven Trusted Screened Levy Specialist Now From The Comfort Of Your Home. A paper levy is a levy generated on a Form 668-A or Form 668-W Notice of Levy on Wages Salary and Other Income and issued through the ACS either systemically or by an employee. The IRS can garnish wages take money from your bank account seize your property.

Trusted Reliable Experts. If the taxpayer in number 1 is over 65 and writes 1 in the ADDITIONAL STANDARD. Review Comes With No Obligation.

A single taxpayer who is paid weekly and claims three dependents has 50290 exempt from levy. Get Your Free Tax Review. Ad Access Tax Forms.

Ad Remove IRS State Tax Levies. The party receiving this levy is obligated to take money owed to you and pay the money to the IRS until your back taxes are fully paid. A lien is a legal claim against property to secure payment of the tax debt while a.

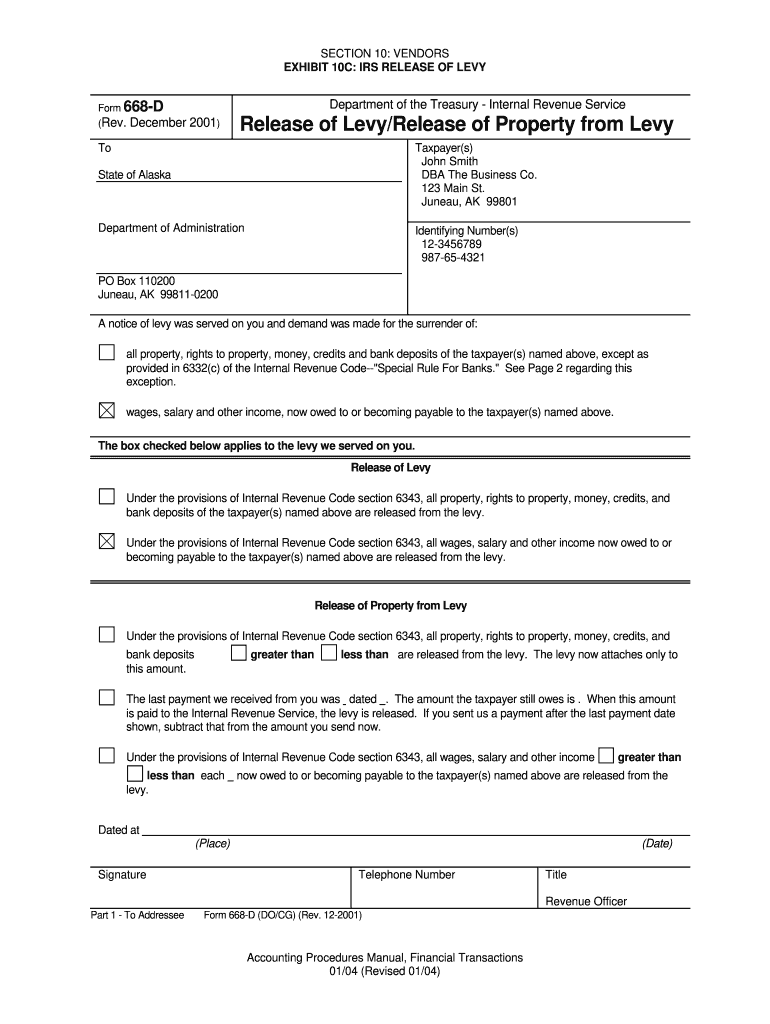

The IRS releases a levy on third parties by issuing form 668-D. The Form tells who the levy was. It is different from a Notice of Federal Tax Lien NFTL while an NFTL.

IRS Tax Levy Help Is A Phone Call Away. A tax levy is a legal process that the IRS takes in order to seize the money you owe in taxes. The release of levy on property seized from the taxpayer is form 668-E Form 668-D has provisions for a partial release of levy.

The IRS also uses this form to create levies on pension and retirement funds. Get A Free Tax Levy Consultation Now. While the Internal Revenue Service has many different tools and weapons available to facilitate the enforcement of tax debts and liabilities one of the most powerful.

Form 668-W is the form the IRS sends to employers when it wants to levy a taxpayers wages. Ad Remove IRS State Tax Levies. It is just a.

The Form 668-A Notice of Levy is sent by the IRS to collect back taxes through an account receivables or bank freezing the funds held in that account. A Notice to Levy is a writ authorizing the Internal Revenue Service IRS agent to seize property or assets belonging to an individual or business taxpayer for collection of debt.

Showalter And Co Cpa Irs Tax Levy Release

Applying For A Tax Payment Plan Don T Mess With Taxes

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs Form 1058 Notice Of Intent To Levy

Irs Levy Tax Matters Solutions Llc

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Fillable Online Form 668 A C Do Rev 7 2002 Notice Of Levy Fax Email Print Pdffiller

Irs Tax Lien Vs Irs Tax Levy What S The Difference Call Maryland Tax Attorney Charles Dillon

No Download Needed Irs Form 668y Pdf Fill Out Sign Online Dochub

Irs Notice Lt16 Your Account Has Been Marked For Enforcement Action H R Block

Tax Letters Washington Tax Services

Tax Levy Understanding The Tax Levy A 15 Minute Guide

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

Irs 12153 2012 Fill Out Tax Template Online Us Legal Forms

Irs Collection Notices Cp14 Cp500s 1058 1153 3172 Form 668

I Owe The Irs Back Taxes Help J M Sells Law Ltd